The chart of accounts helps you organize your transactions into a convenient view of how the money moves through your business. For example, if a company makes a sale, it debits an asset account (like Accounts Receivable or Cash) and credits a revenue account (Sales Revenue), as defined in the COA. The company records each transaction (journal entry or accounting entry) in the general ledger account, and the general ledger totals create the trial balances. A chart of accounts (COA) is a structured list of an organization’s financial accounts used to categorize and record financial transactions. It serves as the backbone of an accounting system, providing a framework for organizing financial data in a logical manner. The COA is tailored to an organization’s needs and can vary widely in complexity.

Download Chart of Accounts Example Template (Excel included)

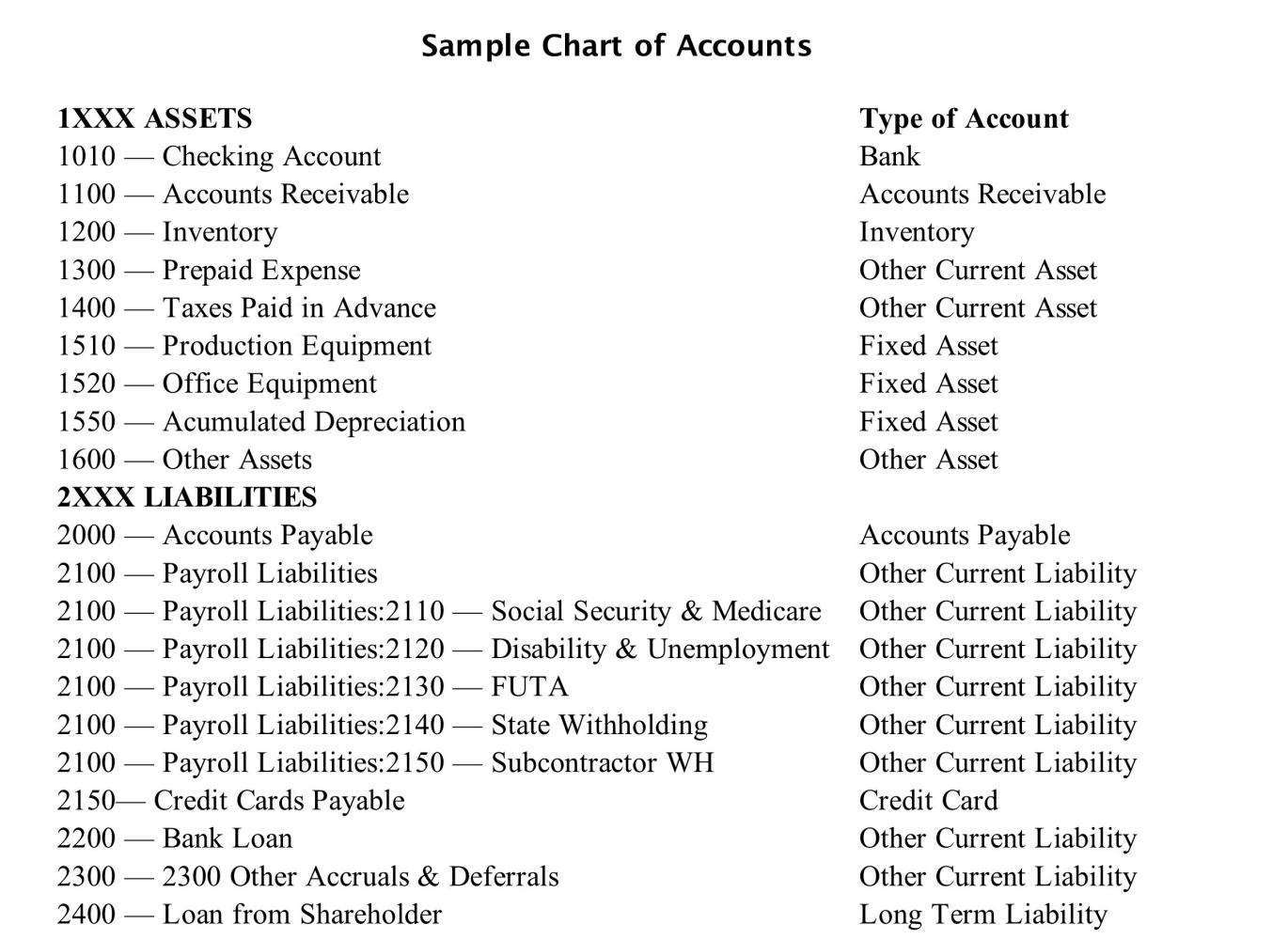

Each account in the chart of accounts is usually assigned a unique code by which it can be easily identified. This identifier can be numeric, alphabetic, or alphanumeric, with each digit/letter typically representing the type of account, company division, region, department and other classifiers. In this article you will learn about the importance of a chart of accounts and how to create one to keep track of your business’s accounts. This way you can compare the performance of different accounts over time, providing valuable insight into how you are managing your business’s finances. In the interest of not messing up your books, it’s best to wait until the end of the year to delete old accounts.

Asset accounts

In this ultimate guide, not only do we explore examples of a common chart of accounts but also we discuss best practices on how to properly set up your chart of accounts. A chart of accounts (COA) is an index of all of the should you hire a bookkeeper financial accounts in a company’s general ledger. In short, it is an organizational tool that lists by category and line item all of the financial transactions that a company conducted during a specific accounting period.

- Your COA is a useful document that lets you present all the financial information about your business in one place, giving you a clear picture of your company’s financial health.

- By ensuring it is well-organized, logically structured, and fully integrated with accounting software that supports real-time data processing and analysis.

- These accounts and subaccounts are located in the COA, along with their balances.

- Think about the chart of accounts as the foundation of a building, in the chart of accounts you decide how your transactions are categorized and reported in your financial statements.

What is a Chart of Accounts? A How-To with Examples

Design it with transparency and compliance in mind, aligning closely with accounting standards. Provide each account with a clear title and a brief description that outlines the types of transactions it should capture. Ensure that everyone involved in financial management and bookkeeping understands the account titles and uses them correctly, which will help maintain the integrity of your financial data.

Actual accounts and numbers can vary depending on each business’s specific needs and structure. Larger businesses may have more detailed accounts, including more specific sub-categories. The COA should be tailored to fit the unique accounting needs of each business, capturing all relevant financial activities. The COA is the financial framework of any business, crucial for accurate financial documentation and analysis. Acting as the financial DNA of business accounting, it provides a detailed directory of various accounts essential for financial accounting practices.

Streamline your accounting and save time

For example, assume your cash account is and your accounts receivable account is 1-002, now you want to add a petty cash account. Well, this should be listed between the cash and accounts receivable in the chart, but there isn’t a number in between them. Advertising Expense is the income statement account which reports the dollar amount of ads run during the period shown in the income statement. Advertising Expense will be reported under selling expenses on the income statement. It provides a detailed framework for analyzing past transactions, invaluable for projecting future financial performance. The structure of the COA also promotes financial transparency and accountability, fostering trust among stakeholders.

Take note that the chart of accounts of one company may not be suitable for another company. It all depends upon the company’s needs, nature of operations, size, etc. In any case, the chart of accounts is a useful tool for bookkeepers in recording business transactions. Accounts are classified into assets, liabilities, capital, income, and expenses; and each is given a unique account number.

Looking at the COA will help you determine whether all aspects of your business are as effective as they could be. If you keep your COA format the same over time, it will be easier to compare results through several years’ worth of information. This acts as a company financial health report that is useful not only to business owner, but also investors and shareholders.

Though most accounting software products set you up with a standard COA or let you import your own, it’s a good idea to have an accountant scan it and add any other accounts that are specific to your business. A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses. Charts of accounts are an index, or list, of the various financial accounts that can be found in your company’s general ledger. These accounts are separated into different categories, including revenue, liabilities, assets, and expenditures. The chart of accounts lists the accounts that are available for recording transactions.

Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances. By ensuring it is well-organized, logically structured, and fully integrated with accounting software that supports real-time data processing and analysis. Ensure the COA structure is compatible with the software, use standardized account numbers and names, and regularly review the integration for any updates or changes in business processes. Regularly back up your data and perform test runs before finalizing any changes or updates to the COA within the accounting software.