Properly maintaining these reports ensures you can act swiftly on overdue accounts. Your finance team will better understand the pace at which receivables are collected from customers, empowering them to give more accurate insights into the financial health of your business. When evaluating a current customer or lead, they’ll be your point of contact for knowing whether doing business with them is worth the investment. This communicates a greater degree of competency to your external shareholders, leading to more investment and fewer compliance issues.

What Is an Accounts Receivable Aging Report?

A critical situation that should not be overlooked is every invoice contains specific payment terms to customers, and some customers are applied to discounts or early payment benefits. The practice of manipulating a company’s financial reports to achieve a desired earnings outcome, often through the use of accounting techniques. The money owed to a company by its customers for goods or services provided on credit. The IRS allows companies to write off aged receivables, but only if the company has given up on collecting the debt. It is determined by adding to $0 any additions to the allowance account during the year, then adding to that total any write-offs of Accounts Receivable during the year. And if there are no additions or write-offs, the balance in the account is zero.

Advantages of Aging Report

Whether it’s your finance team, a dedicated AR team, or even external shareholders like lenders, investors, and tax authorities, this report helps keep everyone on the same page. In an aging schedule, accounts receivables are broken down into age categories, indicating the total outstanding receivables balance. The aging schedule shows the relationship between unpaid invoices and bills of a business with their due dates.

Why accounts receivable aging reports are important

We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others. At Allianz Trade, we are strongly committed to fairness for all without discrimination, among our own people and in our many relationships with those outside our business.

Why do I need an aging report?

- If there are several customers with overdue amounts that extend beyond 60 days, it may signal the need to tighten your credit policy toward existing and new clients.

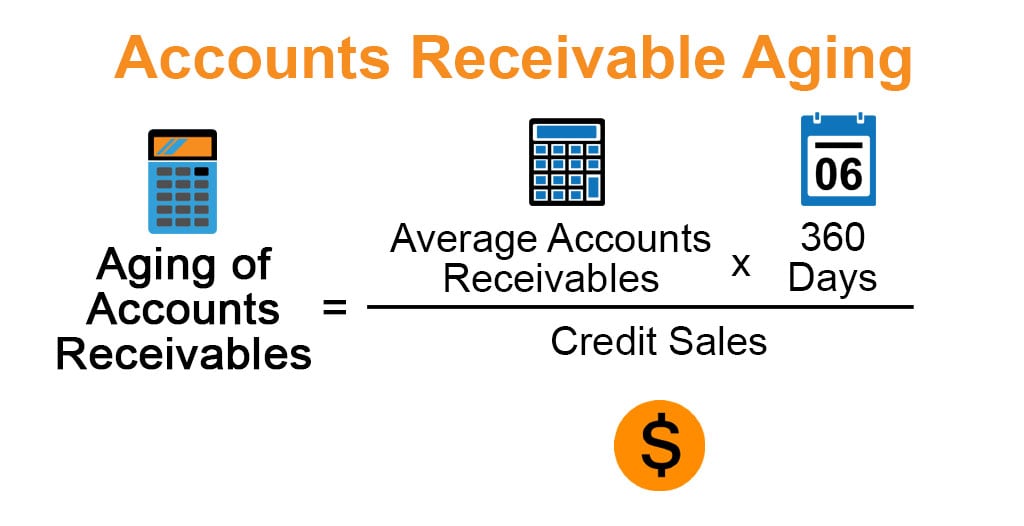

- To determine the amount of uncollectible accounts, an aging method is used for a collection system that is divided into time periods.

- Your AR aging report is a useful tool when deciding whether to adjust your practices and policies for selling and extending credit to clients, such as only accepting cash sales.

- If a company’s billing policy allows customers to pay for products in the future, then the aging report allows the company to monitor the customer invoices.

- For this, record a credit balance that represents the expected uncollectible amounts from your receivables.

Under the accrual basis accounting method, accounts receivables are recorded when a company invoices its customer. All amounts in the aging receivable report are prepared based on some of the amounts invoiced to customers. An aging report is used to show outstanding customer invoices that show an outstanding number of days. If a company’s billing policy allows customers to pay for products in the future, then the aging report allows the company to monitor the customer invoices.

If you go through your aging report and notice a single client is responsible for most of your late payments, you can proceed with any necessary measures. The aging method is used to estimate the number of doubtful debts, which includes the approximate amount of uncollected receivables. The general rule is when accounts receivables remain outstanding for a long period of time. The aging report is an essential tool to estimate potential bad debts used to revise allowance for doubtful debts.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Categories such as current, 31—60 days, 61—90 days, and over 90 days are often used. Credit risk refers to the possibility that a borrower will fail to meet their obligations in accordance with agreed 6 tax deduction tips for homeowners terms, impacting a company’s financial performance. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Businesses can use accounts receivable aging to decide whether to continue doing business with a certain customer or whether to require them to pay in advance or in cash. It can be used to decide whether to pursue an invoice in court or through a collections agency. If the company cannot collect the amount owed, the accounts receivable aging report is used to write off the debt. If your business chooses to factor in outstanding invoices (i.e., sell debts from credit sales for someone else to collect), AR aging reports are a necessary piece of documentation. One of the main uses of an accounts receivable aging report is to identify customers behind on payments.