Order of liquidity is the order in which a company must liquidate its assets in order to meet its obligations. Explore the benefits and potential of hybrid crypto exchanges from both trader and broker perspectives to determine if they align with your financial goals. Ready cash is considered to be the most liquid asset possible, since it requires no conversion and is spendable as is.

In which order assets and liabilities of a company are usually marshalled?

Marketable securities, such as stocks and bonds listed on exchanges, are often very liquid and can be sold quickly via a broker. Furthermore, the order of liquidity serves as a compass for investors, offering valuable insights into the tradability and market dynamics of different asset classes. If you happen to hold these assets in the regular course of business, you can include them in the inventory under the classification of current assets.

Order of liquidity – Financial definition

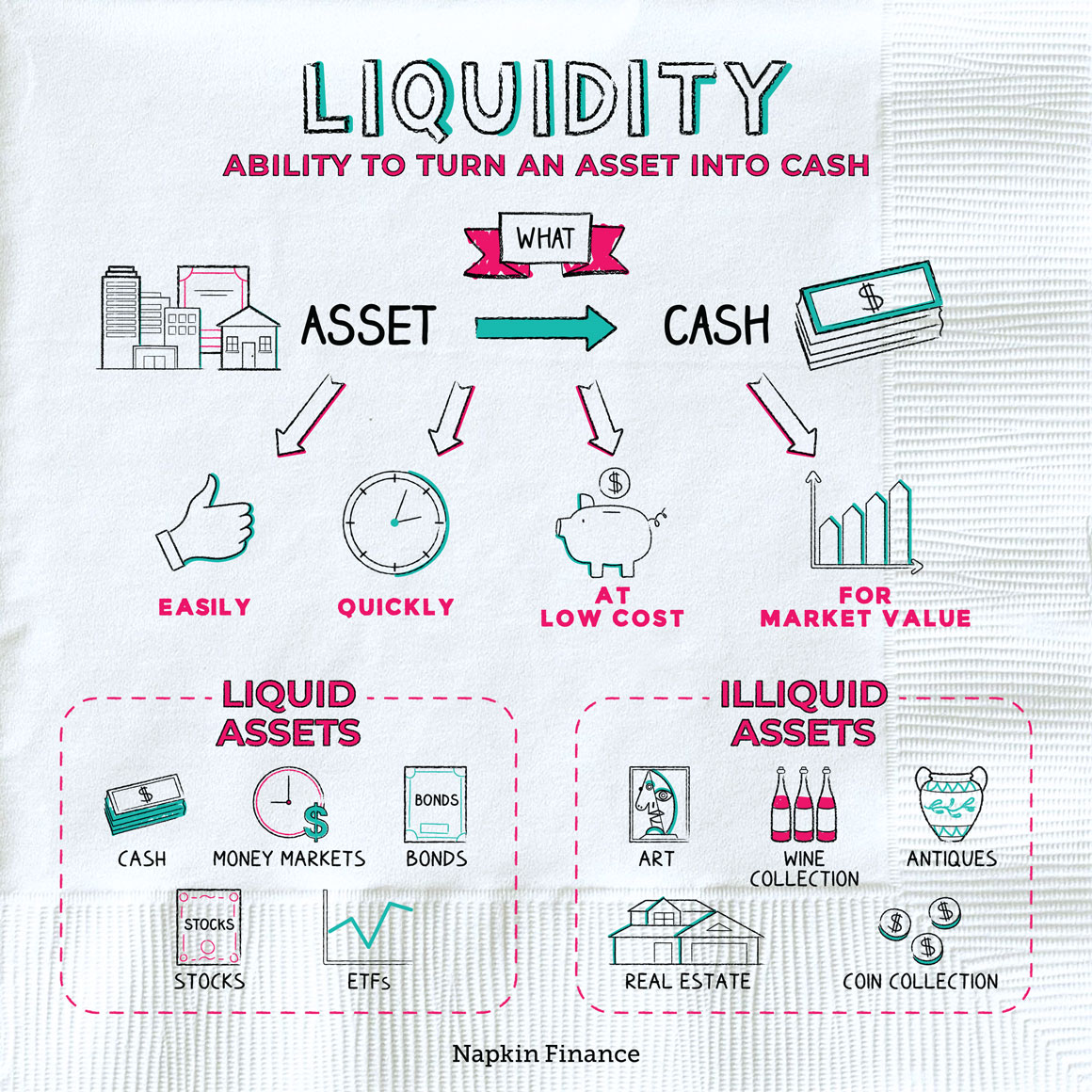

We will explore the importance of understanding the order in which assets can be converted into cash, known as liquidity. From cash and cash equivalents to intangible assets and goodwill, we will break down the hierarchy of liquidity and discuss how it can impact a company’s financial health. The importance of liquidity cannot be overstated, as it directly influences the stability and efficiency of financial markets. Investors and financial institutions rely on liquidity to meet their short-term obligations, manage risk, and capitalize on investment opportunities. Moreover, liquidity is a key determinant of an asset’s value and plays a crucial role in the pricing and trading of securities.

What is financial liquidity?

For instance, changes in tax laws can affect the timing of when these assets can be utilized, creating a potential gap in cash flow projections. By proactively addressing these challenges, organizations can enhance their financial resilience in the face of intangible asset liquidity constraints. Investments include a diverse range of financial instruments such as stocks, bonds, real estate, and money market accounts with varying levels of liquidity and marketability. Understanding the order of liquidity is crucial in finance as it helps assess an entity’s ability to meet its short-term obligations and manage cash flow effectively.

Safeguarding Financial Stability

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Prepaid expenses are advance payments for goods or services, and their liquidity depends on the timing of expenses being incurred and the benefit derived over time. Striking a balance between offering credit to customers and ensuring timely payments is essential. Led by editor-in-chief, Kimberly Zhang, our editorial staff works hard to make each piece of content is to the highest standards. At Financopedia, we’re committed to assisting small businesses and individuals with their finances and taxes.

- Maintaining optimal levels of cash and cash equivalents is essential for businesses to ensure they can meet their short-term obligations and seize growth prospects.

- Liquidity, in the realm of finance, refers to the degree to which an asset or security can be quickly bought or sold in the market without causing a significant change in its price.

- Prepaid expenses are advance payments for goods or services, and their liquidity depends on the timing of expenses being incurred and the benefit derived over time.

- By proactively addressing these challenges, organizations can enhance their financial resilience in the face of intangible asset liquidity constraints.

- This ranking also plays a vital role in risk management strategies by ensuring that sufficient liquid assets are readily available to cover liabilities.

- A CD with a longer timeline than three months can still be considered liquid if you’re willing to pay the penalty to access the funds before the maturity date.

By including marketable securities in their portfolios, investors can strike a balance between risk and returns. Marketable securities are assets that can be easily converted into cash as they have high marketability and are considered short-term investments. An example of order of liquidity can be seen in the classification of assets such as cash, marketable securities, and accounts receivable based on their ease of conversion into cash. what does order of liquidity mean A low order of liquidity signifies that a company has fewer assets that can be quickly converted into cash. If a company consistently displays a low order of liquidity, it might indicate potential issues with paying off short-term liabilities, which could lead to financial instability. Understanding the order of liquidity is important for both investors and business owners because it informs them about the company’s financial stability.

Therefore, the strategic allocation of liquid assets becomes crucial to mitigate liquidity risk exposure and ensure financial stability. It allows analysts and decision-makers to prioritize assets based on their convertibility into cash within a specific time frame. By considering liquidity in financial statement analysis, organizations can better gauge their ability to meet short-term obligations, invest in opportunities, and withstand unexpected financial challenges. Implementing efficient receivables management strategies is key in maintaining optimal order of liquidity.

Shift Markets’ white label crypto market making platform is built to harness the power of aggregated order books, providing clients with deep liquidity, competitive pricing, and advanced trade execution. Designed for simple integration, the Shift Platform equips exchanges with the tools they need to thrive in today’s fast-paced market. Achieving a balanced liquidity strategy is essential to navigate the complex interplay between stability, growth, and risk management in the dynamic world of finance.

Last on the balance sheet is the goodwill, which could be realized only at the time of sale or any other business restructuring. Liquidity is the given adequate consideration or priority when preparing the balance sheet. It is the first document seen by the lenders/investors and other stakeholders to understand the company’s position. Assets that can convert into cash within 12 months are considered current assets, while others are treated as non-current assets. Liquidity in accounting is the ability to quickly turn assets into their monetary equivalent at good prices. The concept of liquidity can be applied to any business organization, securities, real estate, vehicles, and various items owned by an enterprise or an individual.

By monitoring and controlling the timing of these payments, companies can optimize their financial planning strategies and ensure a healthy cash position for future operations. Liquidity, representing the ease of converting assets into cash, serves as a cornerstone of financial markets, fostering efficiency, stability, and confidence among market participants. The order of liquidity, in turn, provides valuable insights into the hierarchy of assets based on their tradability and marketability, guiding investors in navigating the complexities of the investment landscape. While the current ratio is also referred to as a liquidity ratio, a company with the majority of its current assets in inventory may or may not have the liquidity needed to pay its liabilities as they come due. Cash is the most liquid asset, followed by cash equivalents, which are things like money market accounts, certificates of deposit (CDs), or time deposits.