Of this 7.65%, 6.2% goes toward Social Security tax and 1.45% goes toward Medicare tax. Keep in mind that there is a Social Security wage base and additional Medicare tax, if applicable. Gross pay is an employee’s income before taking out deductions. Unless you gross-up an employee’s wages, gross pay is usually the “sticker price” you offer. A number of voluntary deductions are possible, including health plan premiums, garnishments, and charitable donations. Some voluntary deductions can be calculated on a pre-tax basis.

Step-by-step video

- It’s illegal for an employer to help an employee complete a W-4 form.

- Another phrase used for net pay is the amount of money that an employee has cleared.

- Depending on an employee’s marital status, dependents and gross pay, he or she might be allowed to pay taxes over a smaller gross pay.

- Net pay is the amount of money that is earned after taxes and deductions during a certain pay period.

- The pay period is the amount of time over which an employee is paid for completed work.

- Consult these tables or use an online tax calculator to estimate how much federal tax needs to be deducted from the gross pay.

You’ll need to know which specific taxes the voluntary benefits are excluded from, as not all benefits are exempt from the same tax. For example, cafeteria plan benefits are generally exempt from federal income tax, Medicare tax and Social Security tax withholding. However, traditional 401(k) contributions are exempt from federal income tax withholding but not Social Security tax and Medicare tax withholding. There are due payments that are calculated based on gross pay.

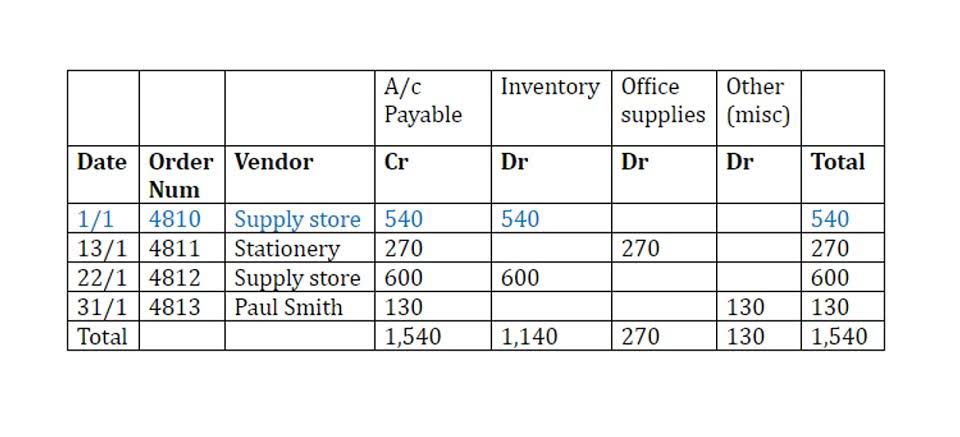

What are the employee’s gross wages for the pay period?

We plan to cover the PreK-12 and Higher Education EdTech sectors and provide our readers with the latest news and opinion on the subject. From time to time, I will invite other voices to weigh in on important issues in EdTech. We hope to provide a well-rounded, multi-faceted look at the past, present, the future of EdTech in the US and internationally.

Important Terms When Calculating Net Pay

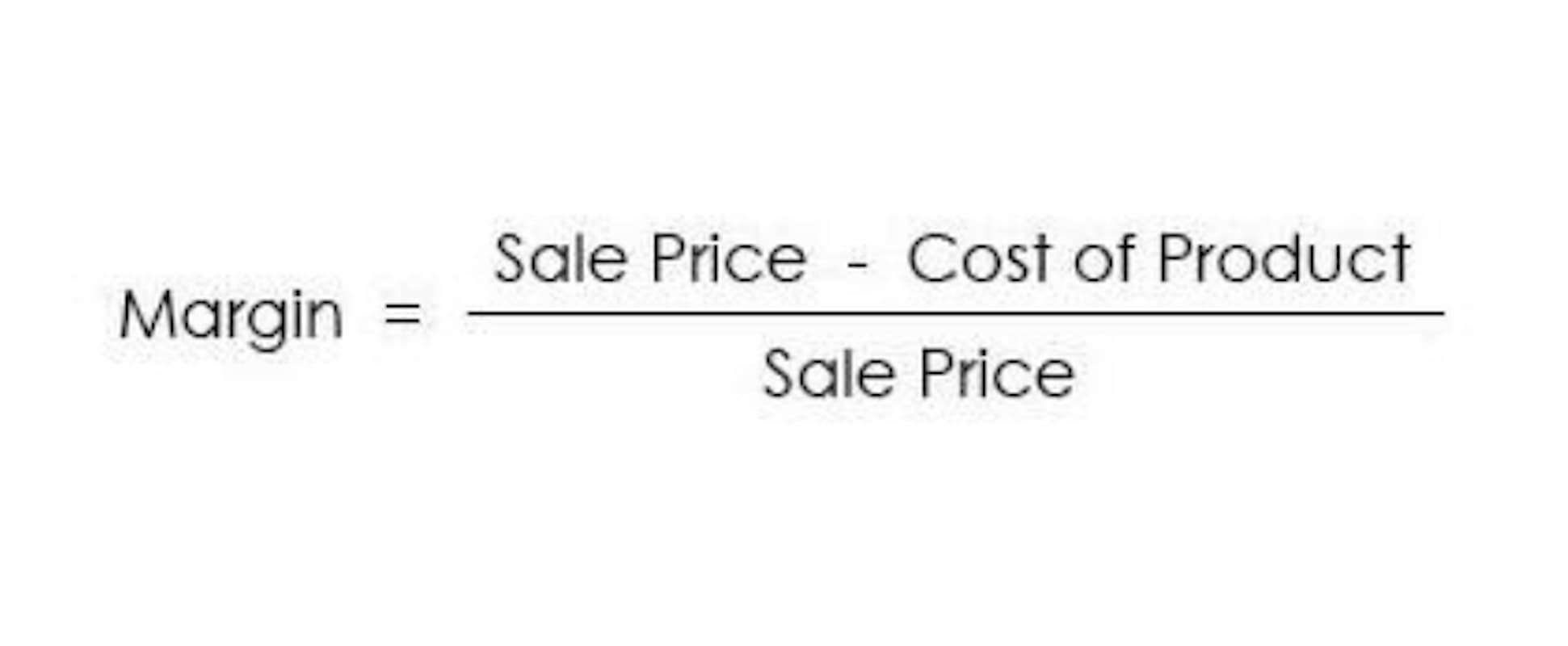

After these $90 worth of pre-tax deductions, the employee will be taxed for $2,910 worth of income instead of the full $3,000 of gross pay. As we’ve mentioned, net pay is the money your employees receive after taxes and withholdings. If you want to learn more about the payroll process and the different types of payroll and income taxes, head over to our complete guide on contribution margin understanding payroll.

Another phrase used for net pay is the amount of money that an employee has cleared. Net pay is the take-home pay an employee receives after you withhold payroll deductions. You can find net pay by subtracting deductions from gross pay.

What Is Net Pay? How to Calculate Net Pay (with Examples)

Since they are deducted prior to taking taxes, they lower the employee’s taxable wages and increase his or her take-home pay. Once the gross pay is known, the taxable income needs to be calculated. Taxable income is found by subtracting all the applicable pre-tax deductions from the gross pay.

How to calculate net pay

If an employee works in several states or different localities within a state, you may have to deduct state income tax from multiple states. If you have employees in multiple states, you may want to get the help of a payroll service to try to keep all of these deductions straight. Gross pay for salaried employees is their annual salary divided by the number of pay periods in the year. Some exempt salaried employees may be eligible for overtime which of the following equations calculates net pay? if their pay level is below $684 a week. In case you don’t, then you can calculate net pay by directly removing taxes and deductions from gross pay.