In the realm of manufacturing, strategic decision-making is a critical component that can significantly influence the success or failure of an enterprise. The cost of production data serves as a cornerstone for such decisions, providing a factual basis upon which strategies can be developed, assessed, and refined. This data encompasses a wide array of variables, from direct costs like raw materials and labor to indirect expenses such as overhead and maintenance.

- This section summarizes the flow of physical units through the relevant processing department and shows the equivalent units for materials and conversion costs.

- This means identifying the purpose, audience, and format of the report, as well as the level of detail and frequency of reporting.

- It’s a tool that offers insights from the shop floor to the executive suite, providing a comprehensive view of the production’s financial health.

- It provides valuable insights from both financial and operational perspectives, helping businesses to optimize their manufacturing processes and maintain a competitive edge.

Beware of Fixed Costs

IntraFish supplies the breaking news and insight to inform better business decisions throughout the value chain, from the sea to the supermarket shelf. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. The data should be visualized and presented in a way that is easy to understand and communicate. The visualization should use appropriate charts, graphs, tables, and diagrams to illustrate the data and highlight the trends, patterns, and outliers.

IDBI Bank opens registration for 1000 ESO vacancies. Check direct link here

The cost of goods sold is the sum of all costs for units started and completed during the period. This section summarizes the flow of physical units through the relevant processing department and shows the equivalent units for materials and conversion costs. Understanding the intricacies of direct materials and labor costs is pivotal in the manufacturing sector, as these are the primary components that directly contribute to the production of goods. The accurate calculation of these costs not only reflects the efficiency of production processes but also impacts the pricing strategy, profitability, and competitive positioning of a company’s products.

Managerial Accounting

This analysis enables stakeholders to make informed decisions regarding investments, budgeting, and resource allocation. It involves examining financial information related to expenses incurred during a specific period. By analyzing cost data, businesses can gain valuable insights into their spending patterns, identify areas of inefficiency, and make informed decisions to optimize costs. Cost reporting is a vital process for any project or business that involves managing and tracking expenses. It helps to ensure that the budget is followed, the resources are used efficiently, and the stakeholders are informed of the financial status and performance.

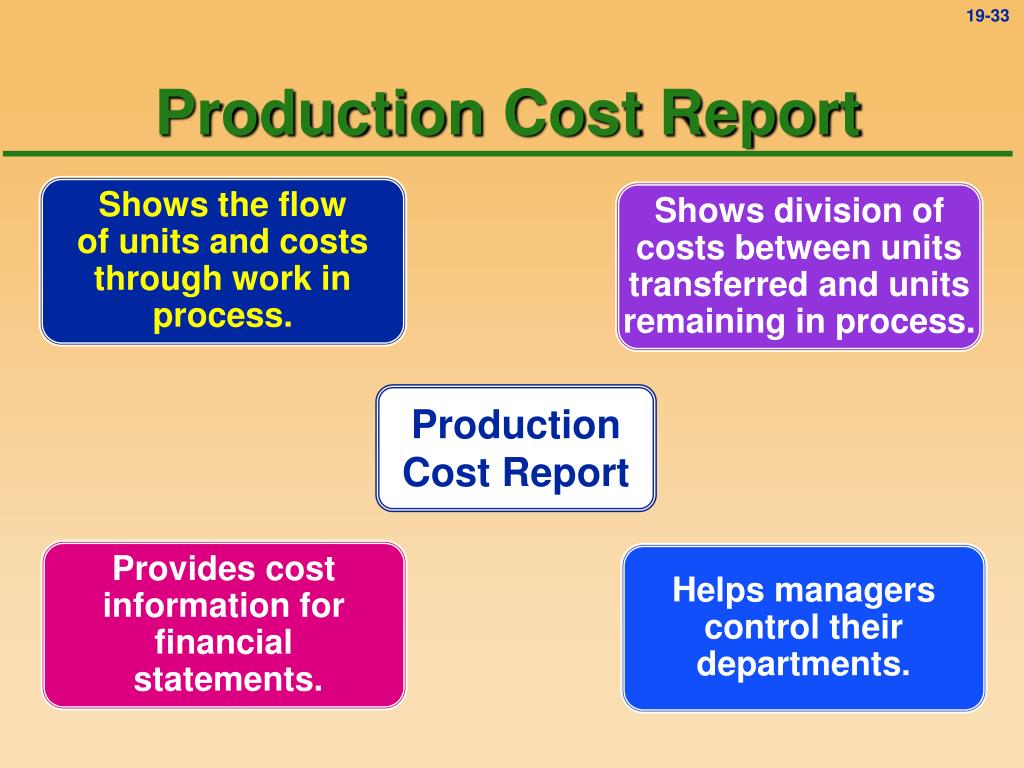

In process costing, Cost of Production Report is also referred to as Process Cost Sheet. Cost of Production Report is prepared at the end of costing period, usually a month. A cost of production report (CPR) shows all costs that are attributable to a department like fixed, variable, total and other costs.

Which of these is most important for your financial advisor to have?

The data should be analyzed and interpreted to generate meaningful insights and conclusions. The analysis should also identify the root causes and the impacts of the variances, as well as the risks and opportunities for improvement. The interpretation should explain the findings and the implications of the analysis in a clear and concise manner. These metrics help to measure the progress, efficiency, and effectiveness of the cost management and control. For example, a positive CV indicates that the project is under budget, while a negative CV indicates that the project is over budget. From the perspective of an accountant, WIP inventory is a balance sheet item that requires careful tracking and valuation.

This example highlights how WIP Inventory reflects ongoing production costs and underscores the importance of accurate tracking and valuation. The cost of production is a complex and dynamic element that requires careful how to make a billing invoice consideration and strategic management. By examining it from various angles and implementing best practices, manufacturers can optimize their operations, reduce costs, and ultimately enhance their market position.

For example, a standardized methodology may include the use of a common cost breakdown structure, a uniform cost accounting system, and a predefined cost reporting template. By following these best practices, one can gather cost data effectively and efficiently for the preparation and presentation of a cost report. Gathering cost data is not a one-time activity, but a continuous process that requires regular monitoring and updating. By gathering cost data in a timely and accurate manner, one can ensure the quality and credibility of the cost report.

Other names used for cost of production report are production cost report and production report. Process costing is preferred by companies that produce identical or similar products. Under process costing, the cost is allocated to the product as per consumptions made during completion in the different processes followed. Cost reporting is a crucial process for any project, as it helps to track the progress, performance, and profitability of the project. However, cost reporting can also be challenging, as it requires accurate data, clear communication, and consistent methodology.

To predict what will happen to profit in the future, we must understand how costs behave with changes in the number of units sold (sales volume). Once the cost per unit is identified, the company assign this cost to the finished goods units and the work in process units. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Some costs will not change at all with a change in sales volume (e.g., monthly rent for the production facility). The data can be collected from various sources, such as the accounting system, the project management software, the invoices, the receipts, the timesheets, and the contracts.