The target sales volume can be derived by tweaking the break-even formulae to incorporate the desired income. At this point, the company will earn sufficient revenue to cover all the fixed costs. Target profit is the desired profit that a business wants to achieve in an accounting or manufacturing period. The conventional approach is to set budgets and compare results against standards.

Target Profit Analysis:

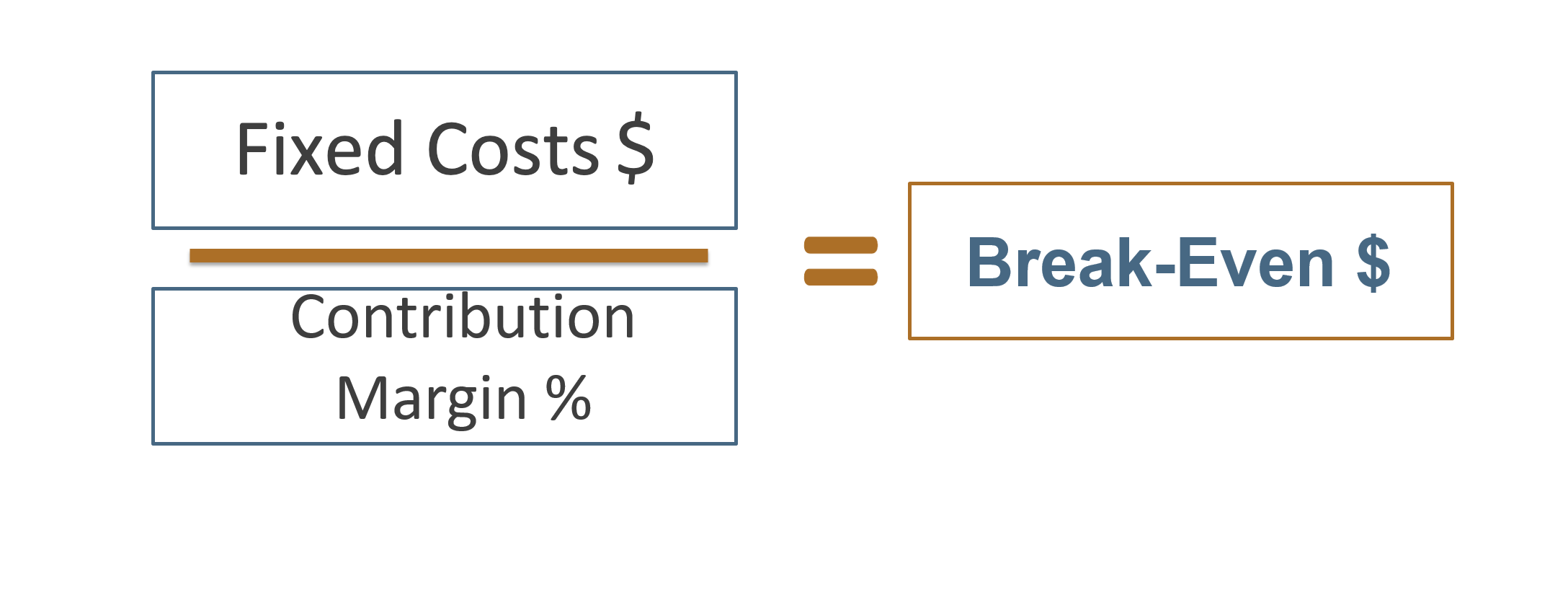

In break-even point analysis article, we used equation method and contribution margin method to calculate break-even point of a company. The same formulas, with a little modification, can be used to calculate the sales both in units and in dollars to earn a target profit during a certain period of time. For example, if the target profit level is 7,000, fixed costs 36,200, and the gross margin percentage is 60%, then the revenue needed to achieve the target profit is given as follows. Moreover, the sales mix can also impact resource allocation and operational efficiency. Products with higher margins might justify more marketing spend or better inventory management practices.

Contribution margin method for target profit:

And with real-life examples backing up our advice, you’re sure to grasp the concepts more readily. You might find yourself asking, “How can I predict whether my sales will hit that sweet spot where profits rise? ” This common plight can lead to missed opportunities and growth stagnation if not tackled head-on.

Calculating Target Profit in Break-even Analysis

However, it also offers some limitations in the form of variance in results, employee demotivation, and unrealistic approaches from the management. Target profit is an integral part of the cost-volume-profit or the CVP analysis. It helps management set profit targets to increase operational efficiency. Without setting time limits the practice of the target profit approach would be futile. For instance, a business can set a dollar amount to achieve through increased sales. Profit percentage is more than just a financial metric it’s a powerful tool that can drive strategic decision-making and business growth.

- As an illustration, suppose the business estimates the market in the first year will be 8,000 units and is has the production capacity to accommodate this.

- Another common non-operating item is gain or loss on the sale of assets.

- Target profit is the amount of money a company aims to make from its business activities.

Target Profit Calculation Formula

For instance, if a company has fixed costs of $50,000, a contribution margin of $10 per unit, and a target profit of $20,000, it would need to sell 7,000 units to meet its goal. To achieve target profit, businesses must first understand the concept of target profit itself. Target profit is the amount of net income a company aims to achieve over a specific period.

Target Profit Calculation – Multiple Products

Let’s say a business has annual fixed costs of £65,000, variable costs per unit of £10 and a selling price per unit of £30. Knowing what target profit is sets the stage for understanding its role in business. Target profit acts like a compass for companies, guiding them towards financial success. It’s not just about making money; it’s about knowing how much money needs to be made to cover costs and achieve growth. Unit variable costs and production volume will remain constant and in proportion as the production level changes.

The total fixed costs apportioning will change as the volume of production changes. Understanding the impact of sales mix on profit is crucial for businesses aiming to optimize their product portfolio and maximize profitability. The sales mix refers to the proportion of different products or services that a company sells. Since each product typically has a different profit margin, the overall profitability can be significantly influenced by changes in the sales mix. For instance, a company that sells both high-margin and low-margin products will see its profit margins fluctuate based on the proportion of each sold. The management can use the graphical method to calculate the break-even sales points as well as target profits for each product.

Delving into the mechanics of target profit calculations, we’ll unpack a methodical approach to pinpoint your financial goals—where precision meets strategy for business triumph. california city and county sales and use tax rates Target profit is the amount of money a company aims to make from its business activities. To figure out this goal, companies look at their sales targets and costs.

Profit percentage, also known as profit margin or profit ratio, is a measure of profitability that expresses the amount of profit earned relative to revenue as a percentage. It indicates how much of each dollar of revenue is converted into profit. For example, think of a restaurant chain that has set a target profit for each location based on factors like foot traffic and operating costs. If the target profit suggests a need for increased production, the company can invest in additional machinery or resources to meet the demand.